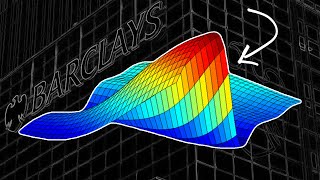

Option Position Delta Explained | Profits & Losses Relative to Stock Price Changes |

|

|

➥ Hypergrowth Options Strategy Course: https://geni.us/options-course

An option's delta only tells you how much the option's price is expected to change relative to changes in the stock price. Position delta tells you how much money you stand to gain or lose when the stock price changes. Position delta is used to gauge directional exposure to the stock price. In this video, you'll learn: 1. What position delta represents 2. How to calculate position delta for basic and complex option positions 3. The accuracy of position delta through a visual trade example tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade. |