Option Sensitivity Measures: The “Greeks” (FRM Part 1 2023 – Book 4 – Chapter 16) |

|

|

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimited-package-for-frm-part-i-part-ii/

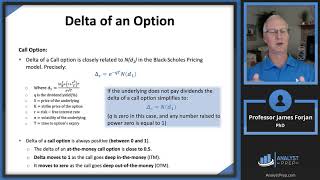

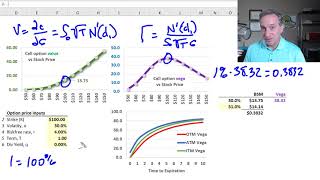

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams* After completing this reading, you should be able to: - Describe and assess the risks associated with naked and covered option positions. - Explain how naked and covered option positions generate a stop loss trading strategy. - Describe delta hedging for an option, forward, and futures contracts. - Compute the delta of an option. - Describe the dynamic aspects of delta hedging and distinguish between dynamic hedging and hedge-and-forget strategy. - Define the delta of a portfolio. - Define and describe theta, gamma, vega, and rho for option positions. - Explain how to implement and maintain a delta-neutral and a gamma-neutral position. - Describe the relationship between delta, theta, gamma, and vega. - Describe how hedging activities take place in practice, and describe how scenario analysis can be used to formulate expected gains and losses with option positions. - Describe how portfolio insurance can be created through option instruments and stock index futures. |