Energy Project Finance Modeling Template Walk through |

|

|

Download the File (Energy): https://www.eloquens.com/tool/e5q4UbBx/finance/project-finance-models/energy-project-finance-infrastructure-model#vertical

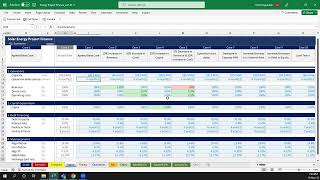

Download the File (Highway):https://www.eloquens.com/tool/D1pAHJ0N/finance/project-finance-models/highway-project-finance-excel-model An infrastructure model that incorporates the following (built using FAST standard): Project finance is the funding (financing) of long-term infrastructure, industrial projects, and public services using a non-recourse or limited recourse financial structure. The debt and equity used to finance the project are paid back from the cash flow generated by the project. a. Well structured inputs that can be updated and changed. b. Project Timing (financial close, construction, delay and operations) c. Two funding Tranches with different repayment profiles (sculpted, principal repayment & annuity). d. Equity funding (prorata and upfront draw option) e. Moratorium period, interest during construction and debt service reserve account. f. Tax computation, capital allowance and depreciation. g. Monthly calculation and consolidated monthly financial, quarterly financial and annual financial. h. Investment evaluation using DSCR, NPV, IRR and Break-even. i. Automated macro (excel vba) to avoid circularity in the model. j. Model balance check. |