Why the RBI does not pay interest on CRR | Banking | Economics (2020) |

|

|

The reason why RBI does not pay interest on CRR balances kept by the commercial banks is covered in the following points:

👉 Should the CRR be abolished? 👉 Why is the CRR so important? 👉 Why did RBI use to pay interest on CRR? 👉 Why did they finally stop? CRR or Cash Reserve Ratio is one of the 2 important Reserve Ratios used by the RBI. The other one is SLR or Statutory Liquidity Ratio. Interest can be earned on SLR but not on CRR. In this video you will learn why this is the case. I will also discuss the relationship between CRR, SLR and LCR (which was introduced by the Basel Norms). You will be surprised to know that the RBI used to pay interest on CRR a long time ago. So why did they stop? Watch the video to find out. This video is a continuation of the Money series and has lots of concepts from banking and economics. RBI Grade B aspirants will definitely find this to be super useful. 🔥How I scored 43 out of 50 in the RBI Grade B Interview: http://supriyopanda.com/how-i-scored-43-out-of-50-in-the-rbi-grade-b-interview/ Check out my other videos below👇 🎥Lebanon Financial Crisis 2019-2020 Explained | What is SECTARIANISM? https://youtu.be/l5Y3oys61EQ 🎥Tell me about yourself? Your weaknesses? & more RBI Interview Questions https://youtu.be/nnCklCSsD4I 🎥Functions of RBI presented in detail and a cool trick to remember them https://youtu.be/oaSGFEve0IM 🙏If you like my content, Please Subscribe!! I make videos on RBI Grade B Exam and other Bank Exam preparation, national and international economic events and any other content pertaining to Finance, Technology, Business and Economics. 🙏Please subscribe to my email list for exclusive content: http://eepurl.com/dqpNhX Social Links 💌 ❤️Follow me on Instagram: https://www.instagram.com/supriyopanda/ ❤️Follow me on Facebook: https://www.facebook.com/supriyo.panda/ Credits: 🎬Video editing: Suparno Panda (https://www.facebook.com/suparno.ZeUs) 🎵Music: https://www.bensound.com |

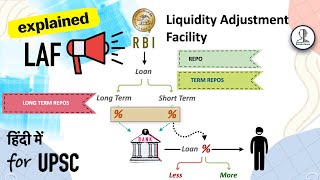

UNIT 2 LEC 2 ||Bank rate , CRR ,SLR , Repo , Reverse repo rate, MSF, LAF,OMO | UPSC CSE ,Govt.Exams|